Use the resources below to learn more about Veterans Affairs loans vs conventional loans

Start your quote for a VA Home Loan

The Team

We have an amazing team that is not only well qualified in helping with refinancing and home loans but also understands on a personal level what it is like to be a part of the military lifestyle. Get to know each team member below!

Devin Fahrner

Mortgage Loan Officer

Devin Fahrner has over two decades of experience in the mortgage and consumer finance industries and uses his knowledge to provide the highest quality services to his clients and their families. A graduate of Western Oregon State University, Devin has worked in nearly every position in the mortgage industry, including working with Reverse Mortgages. The experiences and challenges he’s encountered over the last several years have provided him a vast skill set that allows him to evaluate each client and help enlighten them on the best possible solution to fit their needs.

In addition to his experience in the business world, Devin proudly spent seven years serving in the Marine Corps. His military experience has provided him discipline and a strong work ethic that he has applied in every aspect of his life.

If you have questions about the world of VA Home Loans, Devin and his team are prepared to help. Call us today for a consultation to determine if a VA Home Loan is right for you and your family.

Loan Information

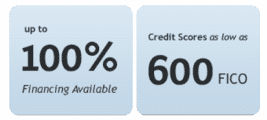

A Veterans Affairs (VA) loan is a mortgage loan that is specifically designed for military personnel, veterans and military families. It is guaranteed by the U.S. Department of Veterans Affairs and is a home mortgage loan issued by approved lenders, such as Devin Fahrner, and is guaranteed by the federal government. Your local American Pacific Mortgage advisor Devin Fahrner will provide you with extensive knowledge on mortgage products and loan options, all while creating a personalized mortgage solution that works for you.

If you or your spouse has served or is presently serving in the U.S. military, you might be eligible for a VA loan. A VA loan offers long-term financing with three types of loans: purchase loans, interest rate reduction refinance loans and cash-out refinance loans. No down payment is needed to purchase a home with a VA loan.

Loan Down Payments

VA Loans

0% Down (for qualified borrowers): VA Loans are among the last 0% down home loans available on the market today.

Conventional Loans

Up to 20% Down: Conventional loans generally require down payments that can reach up to 20% to secure a home loan, pushing them out of reach for many homebuyers.

Private Morgage Insurance (PMI)

VA Loans

No PMI: Since VA Loans are government backed, banks do not require you to buy Private Mortgage Insurance.

Conventional Loans

PMI Required: Private Mortgage Insurance is a requirement for borrowers who finance more than 80% of their home’s value, tacking on additional monthly expenses.

Interest Rates

VA Loans

Competitive Interest Rates: The VA guaranty gives lenders a greater degree of safety and flexibility, which typically means a more competitive rate compared to non-VA loans.

Conventional Loans

Increased Risk for Lenders: Without government backing, banks are taking on more risk which, in turn, can result in a less-competitive interest rate on your home loan.

Qualification

VA Loans

Easier to Qualify: Because the loan is backed by the government, banks assume less risk and have less stringent qualification standards for VA Loans, making them easier to obtain.

Conventional Loans

Standard Qualification Procedures: Conventional options hold stricter qualification procedures that can put homeownership out of reach for some homebuyers.

Get Today's VA Home Loan Rates!

Devin Fahrner NMLS #399405 | AMERICAN PACIFIC MORTGAGE NMLS# 1850